Table Of Content

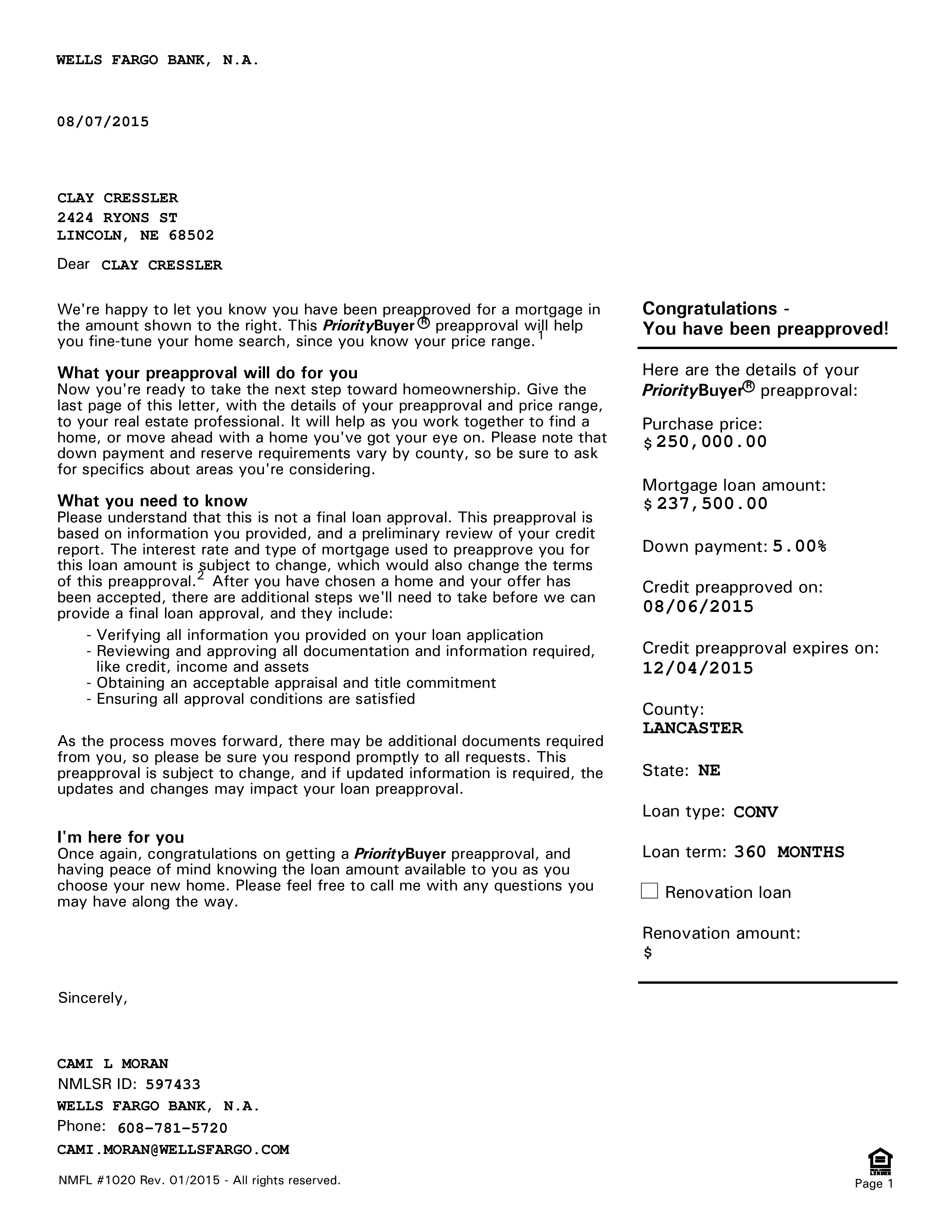

Prequalifications offer a rough estimate of how much mortgage you may qualify for without requiring a credit check or extensive review of your financial situation. Preapprovals give you a firmer estimate and outline the possible interest rates and loan amounts you’ll qualify for based on your credit score and finances. Mortgage pre-approval is an evaluation conducted by a lender to determine how much money they are willing to lend you for buying a home. During this process, you provide the lender with your financial information, including income, assets, debts, and credit history. The lender reviews these details and assesses your creditworthiness and ability to repay the home loan.

A Guide To Conditional Approvals For Home Buyers

It gives you a rough estimate of how much you might be able to borrow. On the other hand, pre-approval is a more comprehensive evaluation, where the lender verifies the information you provide and assesses your creditworthiness in detail. Pre-approval holds more weight and is a stronger indication of your eligibility for a mortgage.

Step 2: Fill out the online prequalification form

You don’t necessarily have to do all the work on your own, either — there are many down payment assistance programs available. Most of them are geared toward buyers who earn under a certain threshold of money each year, offering low- and moderate-income individuals a way to buy a home. For example, Redding and La Mesa are two of the cities with options to help buyers manage their upfront expenses. There are a few first-time homebuyer programs in California that can offer assistance.

Pros of Mortgage Pre-qualification

Getting prequalified is a great way to figure out your home buying budget, but it’s not a requirement. You should be able to look at homes without going through the prequalification process. Here are some answers to a few frequently asked questions to help you decide between a mortgage prequalification and a mortgage preapproval. Getting preapproved for a mortgage will be the best option for most serious home buyers.

Step 1: Choose a lender that offers prequalification

The expiration period can vary, but is commonly between 60 and 90 days. This means that your pre-approval is valid for a specific timeframe, usually a few months from the date of issuance. With an idea of the mortgage amount you might be eligible for, you can better focus your home search on properties within your budget. This can save time and help you set realistic expectations early in the home buying process.

Pre-approval vs. approval

Can I Get a Mortgage if I Have Credit Card Debt? - BECU

Can I Get a Mortgage if I Have Credit Card Debt?.

Posted: Mon, 31 Oct 2022 07:00:00 GMT [source]

On the other hand, mortgage preapproval is based on a more comprehensive analysis of a prospective borrower’s financial health. Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, you’ll need to supply more information so the application is likely to take more time.

Apply for pre-approval

The reason these conflicts don't occur is that the price is often fixed. A seller may hold out for more money, but in general a company operates on a first-come, first-served basis. When rates bounce around from week to week, a buyer looking into a house one day might not be able to afford the same property the next day, she said. “Lenders prefer borrowers with stable employment and income histories because they view them as less risky,” says Vernon.

For example, let's say that three buyers all want the same house for different reasons. Buyer one offers the sales amount, while buyer two offers $275,000 and buyer three offers $300,000. In this case, it’s likely that buyer three will win the bidding war unless another buyer offers a higher amount.

What if I don’t qualify for a personal loan?

Once the lender assesses your credit and financial profile, it’ll decide whether you’re preapproved for a mortgage. If you are, you’ll be issued a preapproval letter stating the loan amount and maximum home purchase price you were approved for, along with the preapproval expiration date. First, real estate agents typically want to see your preapproval letter before they show you houses. This ensures they don’t waste time showing you homes outside your budget. The final step in the homebuying process in California is closing on the house.

It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes. But if your offer is accepted (despite a lack of pre-approval), and it turns out you can't actually get a mortgage, you'll have wasted a busy professional's time -- plus your own. If you’re ready to buy a home within the next few months, taking the extra step to get preapproved can be well worth your time. If you’re a first-time home buyer, you’ll want to be prepared throughout the home buying process. Starting with preapproval is ideal if you know you’re ready to buy a home and want to make a qualified offer immediately.

Your debt-to-income ratio (DTI) helps lenders decide whether or not you’re able to take on more debt. It shows how much money you have going out versus what you have coming in. There are maximum DTIs for mortgage approval, depending on the type of loan.

Just like you should seek a second medical opinion for your physical wellbeing, you should also do so for your financial wellbeing. Don’t settle for the first prequalified loan offer you receive without checking elsewhere. Different lenders may provide more favorable options, including b better APRs, loan terms and potential discounts. If you’ve never owned a home before — or if you haven’t owned one within the last three years — the California Housing Finance Agency considers you to be a first-time homebuyer.

Other loan types, such as VA loans and USDA loans, do not have government-mandated minimum credit scores, however, lenders often set their own minimum scores. Generally, the higher your credit score, the lower interest rate and better mortgage terms a lender will offer you. Each time you apply for a loan preapproval or approval, a lender checks your credit with a “hard pull.” This typically lowers your score by a few points. However, FICO® states your credit score generally won’t be negatively affected if you make all your inquiries on a home loan within 30 days. That means the best time to get preapproved is at the start of your home buying journey.

When you prequalify for a home loan, you’re getting a general estimate of how much a lender will allow you to borrow. When you prequalify for a home loan, you’re getting an estimate of what you might be able to borrow, based on information you provide about your finances, as well as a credit check. Preapproval is not a guarantee you will receive a loan, and the mortgage can still be denied. A home appraisal must be completed before a loan can close to ensure you aren’t paying more for the home than it’s worth.

It will help you narrow in on your dream house and stand out to sellers. After you’ve been prequalified for a mortgage, you can pursue mortgage preapproval. You’ll need to speak to a home loan expert and provide documentation to verify your income and assets. In order to preapprove your mortgage application, the lender will need certain documents to verify your income, job stability and other factors.

Based on this overall financial picture, the lender estimates how much you may be able to borrow. Mortgage pre-approvals usually have a minimal and temporary impact on your credit score. While the credit check involved in the pre-approval process is considered a hard inquiry, it typically results in only a slight decrease of a few points or less.

No comments:

Post a Comment